If you’ve been looking at the skyrocketing costs of vehicles and wondering how you will finance your next car, you’re not alone. With long wait times, limited selection, and little room for negotiation, buying a car right now can feel like a hassle—without having navigating financing options for those increasingly expensive sticker prices. What is causing these price surges? Jared Wyrick, president of West Virginia Auto Dealers Association, describes the situation as a combination of demand after the initial lull with the pandemic, extra money from stimulus packages, and a shortage of semiconductors—computer chips necessary for all the high-tech wizardry of new vehicles. “It’s ECON 101,” he explains, “the demand is there but the supply is not.”

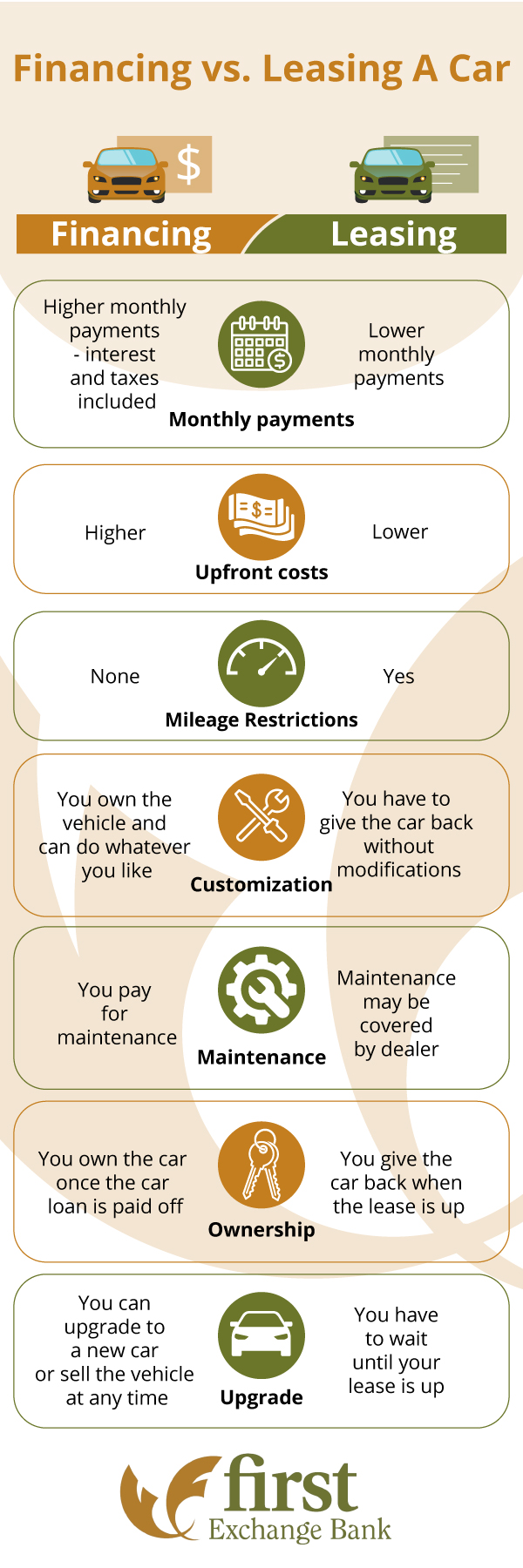

While leasing—an option that offers lower monthly payments—might seem like a great option, it sometimes seems to have fallen out of favor. With a high of about 34% in 2017, leases now make up only about a quarter of new car arrangements in the US. However, here in West Virginia it’s even lower: only 8%. On the other hand, though financing your vehicle with a loan may be more popular, it will definitely cost you more up front and each month—money you won’t recoup until you sell your vehicle down the road.

If you aren’t sure which option to choose, this post is right for you. We’ll cover the basics of leasing and financing vehicles, the pros and cons of both, and the main factors you might consider to help you determine which one will work best for your unique needs and budget.

What does it mean to lease a car?

When you lease a car, you are paying to use it, with the benefit of some maintenance included. When you’re done with your lease, you’re expected to return it in the same condition that it was when you originally received it, and if it’s not, you’ll be charged for any damage that goes beyond the usual wear-and-tear. This type of arrangement may sound unique and it is as Investopedia explains, “Leasing a vehicle is similar to renting an apartment in that you make monthly payments while enjoying temporary use of the vehicle.”

Just like getting a loan, you need to have decent credit to lease a new vehicle with good terms. According to Car and Driver, over 680 is good, and the lower the score, the more you will pay at signing—if you are able to get a lease for a new vehicle at all. If your score is too low, you might qualify for a used car lease instead.

Monthly payments tend to be lower, which is a major appeal of leasing over buying a vehicle with a loan. However, it is not necessarily the best financial investment. As Consumer Reports points out, “you’re just borrowing and repaying the difference between the car’s value when new and the car’s residual—its expected value when the lease ends—plus finance charges.” At the end of the lease term, you might owe the dealer money, with nothing to show for your payments.

What are the benefits of leasing a car?

Despite the fact that leasing will likely end up costing drivers more money than buying, a significant portion of new cars are leased each year. So why do so many people choose to lease cars?

- Lower payments. The average monthly car payment is around $644 for loans, vs. $531 for leases. This is because you’re not paying for the actual vehicle—just the value you use during the time you’re driving it.

- Newest models. If you continuously lease you will always have a new, recent model car, with all the latest tech bells and whistles.

- Nicer vehicles. You might not qualify for a loan for a more expensive car, but you may be able to lease the same vehicle, because the monthly lease rate will be lower.

- No trade-ins. At the end of your lease, you don’t have to worry about selling your car yourself or trading it in. As long as you didn’t have excessive wear-and-tear or go over your allotted mileage, you can turn it in and walk away.

At this point, we’ve mentioned the benefits of leasing. While the differential might seem slim at only about a $100 a month on average, when you see how it plays out in the real world it might make more sense for you, especially if you are on a tight budget like many Millennials and Gen Zers. As Edmunds writes, “There is a dramatic difference between what Millennial shoppers can afford when they choose to lease compared to when they choose to buy.” In a survey they conducted with Morpace Inc, they found that more than half of Millennials would not put more than $2,999 down or pay more than $299 a month. For those who financed, that would limit them to vehicles under $20,000, while lessees could qualify for one valued up to $35,000!

What are the cons of leasing a vehicle?

While there are definite benefits to leasing a vehicle in certain cases, the fact that the lion share of people looking to purchase a new vehicle choose to buy over lease. It almost always comes down to this: even if you have a lower monthly payment when leasing, you own nothing in the end. If you average the out-of-pocket cost of buying a car with a loan, factoring in the value in the end when you go to sell it, there is a clear winner—and it’s not the leased vehicle. In fact, over a six-year period, leasing can cost you about $8000 more over buying the same vehicle. Here’s a breakdown of the cons of leasing:

- Payments without ownership. If you constantly lease, you will always have a car payment, but never own the car. Whereas if you purchase, once you pay off the loan the car is yours and you can allocate your monthly car payment to let’s say a savings account for the purchase of your next vehicle.

- Mileage overage fees. With annual caps of around 12,000 miles and fees of 15-20 cents per mile, you may face large charges when you go to turn in your car.

- Wear and tear. If your vehicle has any damage, inside or out, that is deemed beyond normal usage, you’ll be required to pay for it.

- Pay for depreciation. Leasing a new vehicle costs more because you are essentially paying to rent something during its most rapid period of depreciation (2-3 years), rather than holding onto it as depreciation stabilizes after a few years.

- Limited customization. You can only make customizations to your car at the beginning of your lease. For instance, you won’t be able to add a different radio or spoiler once the car is off the lot.

- Strict terms. You are expected to pay for the lease for the whole agreed-upon period. If you want or need to terminate the lease, you’ll probably need to pay a termination fee. According to Credit Karma, this could cost you thousands of dollars and require you to get a loan just to terminate your lease.

- Stricter credit requirements. Leases are rarely available for those without good credit, whereas loan requirements can be more flexible and you may be charged a higher interest rate for a lower credit score.

What does it mean to finance a vehicle?

When you finance a vehicle, the entire cost of the vehicle, plus financing charges, will be spread out over an extended period called a loan term. Contracts of 72 months or 6 years are common, though they usually come in 12 month increments and your term will depend on both your down payment and your budgeted monthly payment amount. In the end, you will own your vehicle with a value dependent on many factors including how well the vehicle was maintained, the term of the loan, and vehicle mileage, just to name a few.

To get a loan, first you have to qualify. Though you don’t have to have perfect credit, the better your credit, the less expensive it may be for you. It’s a good idea to check your credit (credit score and report) before you start the process. Then you’ll want to compare quotes from a variety of lenders, including online lenders, local community banks, and finally, dealerships. As NerdWallet points out, sometimes dealers have the best deals for you, but “your own community bank may give you a preferred rate, especially if you agree to automatic loan payments from a checking account there.”

Your monthly car payment isn’t just the price of the car spread over a certain number of months—it will include a number of charges: principal (cost of the car), and interest, and possibly credit insurance, optional add-ons, and late fees if you miss a due date. The average monthly payment for residents of West Virginia is $525 for new cars and $320 for used cars. Also keep in mind, if you fail to make a payment for 30-90 days, your car could be repossessed.

What are the benefits of financing vs. leasing a vehicle?

If you’re like most people and simply don’t have the cash to purchase a vehicle outright, but don’t like the downsides of just leasing, a loan might be right for you.

- Vehicle ownership. Once your loan is paid off, the vehicle is yours. You can keep it to decrease your vehicle costs, sell it, or trade it in to offset a new vehicle purchase.

- No mileage restrictions. While too many miles can make your car harder to sell later on, you won’t be charged at the end of your loan term if you put a lot of miles on it.

- No wear-and-tear worries. Though it can reduce the value off of your vehicle, you don’t have to worry about dings and crayon scribbles costing you an arm and a leg.

- Freedom to customize. You can make any customizations or modifications you want any time you want.

- Lower long-term costs. As mentioned already, you will save a significant amount of money over leasing when you calculate in the value of the vehicle at the end of your loan term.

When to lease or finance a vehicle

With all the pros and cons of leasing vs. financing, it can be hard to determine which is right for you. Consumer Reports has an excellent table of side-by-side comparisons for leasing and financing which could help clarify your decision. Additionally, consider the following factors that might help you make your decision:

When you might prefer to lease:

- You can’t afford the monthly payment on the car that you want or need with financing.

- You don’t have enough money saved for a down payment but are in need of a vehicle.

- You don’t want to be locked into one vehicle for more than a short time (perhaps you intend to save to buy a new vehicle in a few years, or expect to start a family soon and know your vehicle choice will change).

- You prefer to have the newest model, and will pay a premium for it.

- You care more about eliminating the hassle of buying than reducing your overall costs.

When you might prefer to buy with a loan:

- You plan on having this vehicle for more than a couple of years.

- You want to take advantage of the long term cost savings of a loan.

- Your credit isn’t quite good enough for leasing.

- You want to be able to modify the vehicle to suit your needs and style.

- You know you will put more than 12,000 miles per year on your vehicle or will be rough on your vehicle.

- You have some savings for a down payment that can reduce the cost of your loan (note though, not all loans need a down payment).

In the market for vehicle financing?

If, after careful consideration, you determine that financing your new car with an auto loan is the right choice for you, rest assured there are many options out there that can meet your needs and save you money in the long run. Many buyers go straight to the dealer for financing, and while that can work out for many, it’s not always the most economical choice. As the FTC points out in their guide, Financing or Leasing a Car, “The dealer’s relationships with a variety of banks and finance companies may mean it can offer you a range of financing choices. Keep in mind, however, that the dealer typically profits from offering financing and may not always offer you the best deal.” Exploring multiple financing options—including your local community bank—can help you get the best deal on your new vehicle loan.

At First Exchange Bank, we offer competitive rates and flexible terms for auto loans, including 100% financing (no down payment) and a variety of options to meet your needs and your budget. We work with many local dealerships directly—simply mention First Exchange Bank to your dealer to apply for a loan through First Exchange Bank right from their showroom. Existing customers have the added benefit of making hassle-free payments from your First Exchange checking account or savings account!

Want to learn more about how we can help get you in that new vehicle? Stop by today at any of our convenient North Central West Virginia locations in White Hall, Morgantown, Hundred, Fairview, Fairmont, or Mannington and we’ll help you find a vehicle loan that is right for you.