“Teamwork is the ability to work together toward a common vision. The ability to direct individual accomplishments toward organizational objectives. It is the fuel that allows common people to attain uncommon results.” Andrew Carnegie

In the late 1920s our nation was plunged into some of the darkest days we have ever faced. This dark time of despair became known as “The Great Depression.” Stories of economic failure and disaster were commonplace. West Virginia was no exception to this crisis, as the national downturn ushered in the “most disastrous event in West Virginia banking history.”

Just a few years prior, in 1924, West Virginia’s banking industry reached its peak with a total of 350 banks throughout the state. By 1933, that number had been reduced to a mere 180. Entire communities were left without a financial institution. Bank failures and bank runs became common occurrences.

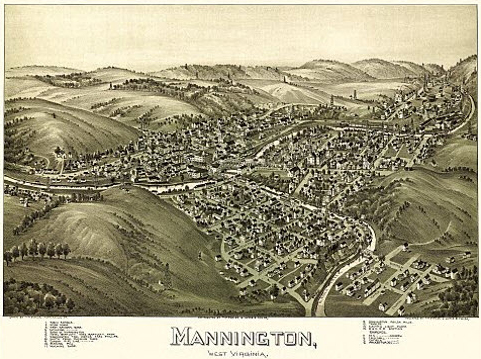

As the Depression marched on, bank runs happened close to home, with a run on the Citizens Bank in Weston in October 1931, and on the Second National Bank in Morgantown later that month. It was in the midst of this deep crisis that a visionary entrepreneur and statesman, George W. Bowers, knew that immediate, decisive action was needed. In his chosen home of Mannington, the three existing banks faced potential ruin. Moving quickly, Bowers used his personal wealth, earned through his success in pottery and glass manufacturing, along with his business acumen and stellar reputation to coordinate the merger of the three banks. On June 25th, 1932, The Bank of Mannington, the First National Bank of Mannington, and the Exchange Bank of Mannington were officially combined into the new First Exchange Bank, with George Bowers at the helm as President.

The Bank survived the Great Depression. Through the many ensuing trials, downturns and rough patches First Exchange Bank has continued to prevail. One of the exceptional qualities that George Bowers possessed was the ability to cut through the noise and distractions and rally a group of people around a clear objective. That quality enabled his organizations to thrive despite the myriad of obstacles that would inevitably litter our path to sustained success.

I was honored to be selected as the ninth President of First Exchange Bank in July of 2006. Throughout my tenure, our team has made a concerted effort to build on the principles that we were founded on, and to build an organization that would sustain and grow for future generations, as it has in the past. Over the next month, I want to share with you five key principles that have helped us become one of North Central West Virginia’s premier community banks. These principles are modeled from the book Mastering the Rockefeller Habits authored by Verne Harnish. The most critical principle is aligning our Executive Team, which we will refer to as developing a theme.

Leadership Principle #1: Develop a Theme

In times of uncertainty, lack of clarity for the next step can be devastating to productivity and can even threaten the long-term viability of an organization. At the time First Exchange Bank was founded, there was a clear objective: Survive! George Bowers set about removing all other objectives to focus on the one that would make the most critical impact. Having one clear goal, Bowers was able to bring his team together around this shared mission. Everything that we did in those early years laid the foundation for the type of bank that First Exchange would become. Today, the principle of Developing a Theme remains one of the pillars on which our strategy is built on. Our Executives and Directors are aligned by spending time each year laying out the 3-5 priorities and goals that we have for the coming year, which are fortified by long term macro goals with which we challenge ourselves.

We take our 3-5 annual goals and break them down into quarterly steps (we call them “Rocks”). Then each quarter, we break the “Rocks” into monthly, then weekly projects, tasks and goals. Our executive team then repeats this with each of their team members, until our organization is aligned around a set of specific, measurable goals.

Each quarter, we realign and evaluate our “Rocks” and develop themes to further galvanize our team around our mission for that quarter. This not only creates a sense of urgency, but it further allows everyone in our entire organization, from the bottom to the top to understand what their role is in the success of the Bank as a whole. Information is disseminated with our staff through a series of huddles between managers and our staff.

As we have faced the challenge of COVID-19, this strategy has allowed us to maintain a strong level of service and productivity. At the outset of the crisis, our leadership immediately realigned by pivoting our focus on the new challenges that COVID brought and we simply realigned our “Rocks” and communicated the new information throughout the organization through our huddles. Through our established system, we were able to redirect the efforts of our entire organization quickly and efficiently to the most critical areas.

We are all facing unprecedented times and uncharted waters. The principle of Developing a Theme has helped us grow into who we are today, and I hope that it can help you too as we work together to grow beyond our current challenges. I anticipate that in the coming days we will begin to see more light, but for now, we can look back and learn from many lessons left by those who have gone before us.

William Goettel, CPA

William Goettel, CPA

President & CEO, First Exchange Bank