Mortgage Loans

Mortgages

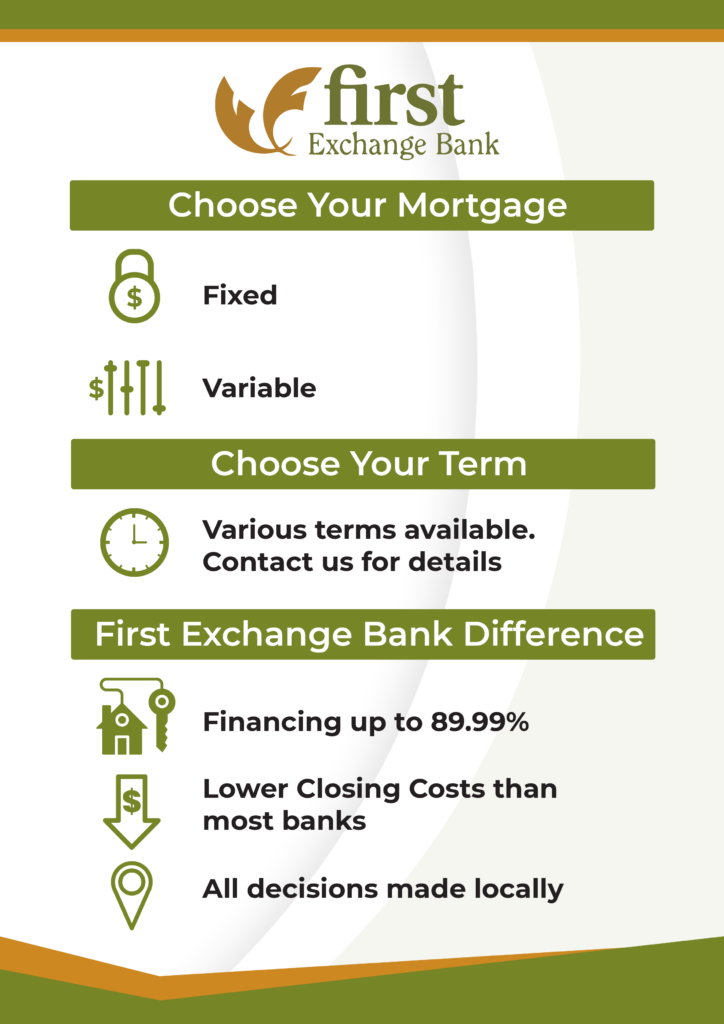

Buying a home is a major life event, but it doesn’t have to be stressful. First Exchange Bank makes the process simple and provides friendly service from beginning to end. As a longtime community bank, we understand that each of our customers are different. Our knowledgeable mortgage loan officers can help you choose from a variety of mortgage options to fit your specific needs. Our local in-house lending means lower closing costs than most banks and finance up to 89.99%.

Home Loans in North Central West Virginia

First Exchange Bank offers many different types of home loans. Whether you’re buying your first home, a second home, or want to build a new house, we have a mortgage loan that is right for you.

- Conventional Loans – Primary and Second Homes

- Construction Loans – Primary and Second Homes (Read more about our single close construction loans)

- Vacant Land Loans – Terms dependent on type of land (improved with utilities or unimproved without utilities)

- Manufactured Home Loans – Doublewides and Permanent and Tier Foundation Options available

Fixed-rate Mortgages

Lock in your rate with a hassle-free fixed-rate mortgage from First Exchange Bank. With a fixed-rate mortgage, your interest rate will stay the same throughout the life of the loan.

Variable-rate Mortgages

Finance the way you want with an adjustable-rate mortgage from First Exchange Bank. With a variable-rate mortgage, your mortgage rate if fixed during the initial period. After the fixed-term ends, your monthly rate can vary based on the current mortgage rate.

Go To Great Heights With A Mortgage Loan From First Exchange Bank!

Contact your local First Exchange Bank office and let us help find the loan that’s right for you. We possess local expertise in the real estate markets of Morgantown, Mannington, White Hall, Hundred, Fairmont, Fairview, and beyond.

Apply Online For A First Exchange Mortgage Loan Today!

*Subject to credit approval. Please contact your local First Exchange Bank for current interest rates.