Personal Credit Lines

Personal Credit Lines

Benefits of a Personal Line of Credit

Benefits include

- Flexible: There when you need it, but you don’t have to use it.

- Convenient: Linked to your checking account for easy transfers between accounts.

- Affordable: Option to make interest-only payments.

- Overdraft protection: Can be used to cover overdrafts in your checking account.

- Unlimited uses: Personal expenses, home remodeling, and anything else you need.

What is a Personal Line of Credit?

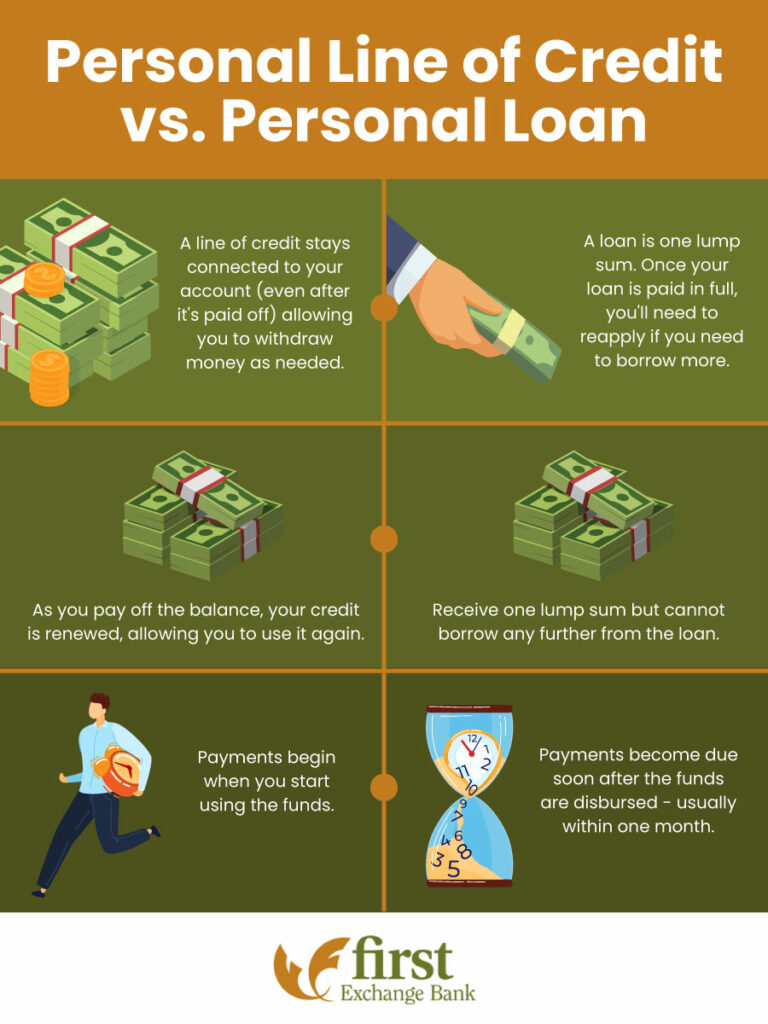

A personal line of credit is a type of revolving credit account, similar to a credit card, which lets you draw funds as needed up to the limit. Personal credit lines are connected to your First Exchange checking account, which makes it easy to transfer money back and forth when you need to borrow or make a payment.

Unlike unsecured loans and cash secured personal term loans, a line of credit doesn’t give you a lump sum upfront or operate on a fixed repayment schedule. Instead, it’s there when you need it and you won’t have any payments due until the first time you draw funds.

How To Apply For a Personal Line of Credit

Applying for a personal line of credit is a pretty simple process. You’ll just need to provide basic information such as your name and address, photo ID, social security number, and current income. Contact one of our loan officers to learn more!

Apply For A Personal Line Of Credit Today!

Compare a personal line of credit vs. a home equity line of credit.

*Subject to credit approval. Please contact your local First Exchange Bank for current interest rates.