West Virginia has become a destination for higher education. In fact, we rank fourth in the US for number of colleges per person, with nearly 8% of our residents being students. It’s no wonder with Morgantown’s own world-renowned institute, West Virginia University, home to almost 30,000 students alone.

As a parent or guardian of a current or soon-to-be college student, you will face a lot of difficult financial decisions, and determining how you and your student can afford rising tuition and living costs can make for trying times. But these years are also key to helping your student develop smart financial habits, ones that will help them for years to come as they seek out their first major jobs and set out on their own. In this post we’ll provide some tips and advice on how you can help your student navigate these crucial years, like opening a student bank account and budgeting for expenses, while avoiding some common pitfalls that can create hurdles to their future success after graduation. Keep reading to learn more about how you can help prepare your student for a smooth transition to independence and a prosperous financial future!

Budgeting Tips for College Students

Many college students will be managing their own finances for the first time in their lives. Understanding the concept of financial balance—that money coming in should be greater than money going out—is often easier said than done. It’s a good idea to help your college student create a workable and accurate budget, even if you will be helping them with expenses while they’re in school.

Working together setting a budget will also give you a better idea of what your college student is dealing with in terms of debt and financial strain, which can help you guide them to make better choices, while alleviating tensions based on unrealistic expectations. Below you will find a few important things to do with your student to ensure that they can maintain that crucial financial balance.

Determine Who Will Pay for What Expenses

You may already have some kind of agreement in place about what your contribution to your student’s education will be. According to the Institute for Social Research at the University of Michigan, more than 60% of young adults aged 19-22 receive help from their families, with an average annual amount of $7,500. The amount you are willing and able to contribute, especially toward expenses outside of tuition, can be a difficult number to determine. And even if you think you found the perfect number, it might end up changing once you see their actual budget, after they score a lucrative summer job, or an unforeseen event or expense arises.

To help you figure out how to best divvy up expenses, wait until all financial aid information is available and a rough monthly budget is calculated. Then revisit your contribution every so often, based on your students needs, performance, and your ability to assist them. The Collegiate Parent interviewed several parents to learn about their systems for assisting their children in college. Some parents considered college to be the “job,” covering their student’s expenses, while others gave a monthly allowance of about $200, only when their student didn’t earn enough themselves to foot the bill for their own expenses. Ultimately, be clear about what your contribution will be, but don’t be afraid to revisit that number if circumstances change.

Create a Budget Together

Ordinarily, budgets should follow what is sometimes called the 50/20/30 Budget Rule. As Investopedia explains, “The basic rule is to divide up after-tax income and allocate it to spend: 50% on needs, 30% on wants, and socking away 20% to savings.” However, for a college student, who may have many of their needs taken care of by parents, scholarships, and loans, and little income for savings, you may find the ratios in need of a little tweaking, even if the 3 basic expenses remain. And keep in mind, income and spending may differ drastically between the school year and the summer—it’s a good idea to make separate budgets for each time period.

First, you’ll need to calculate total income. This can include a parental allowance, part-time job or work-study job, stipend, or leftover financial aid. Some kinds of income, including refunds received from the financial aid office, scholarships, and family gifts, will be received in a lump sum rather than weekly or monthly. For this income, it’s better to divide it up over the total months your student is in school during the year, starting with the first month you receive it. This will help avoid the problem of creating overspending habits in the wake of a windfall.

Next, make a list of expenses, subtracting the sum from the income total calculated above. If it’s a one-time expense you expect in the future, you can either divide it by the number of months in the school calendar (or months left until it needs to be paid) to be sure enough income is set aside each month to cover it.

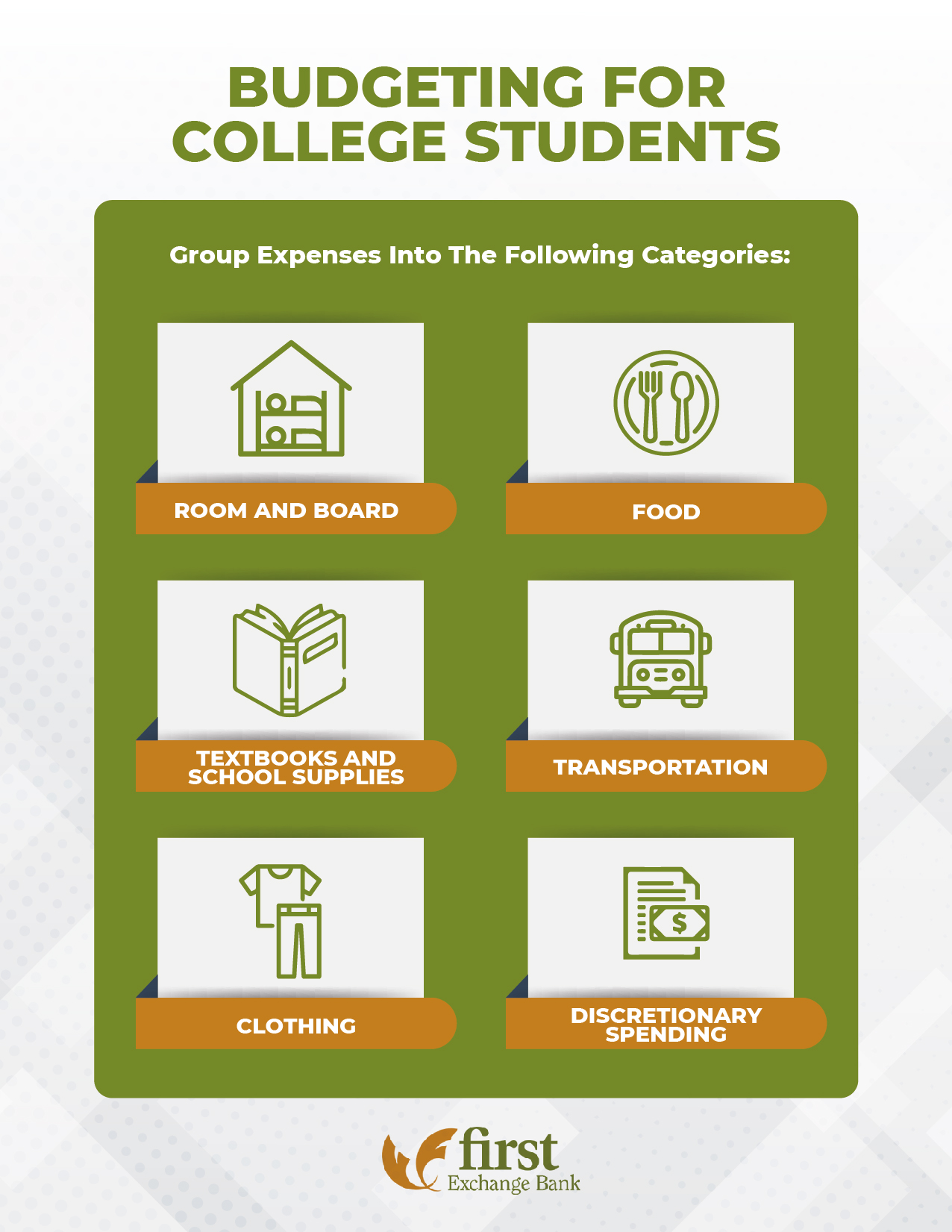

In order to organize expenses and make the budget simpler to follow, it’s helpful to group them together in basic categories:

- Room and board

- Food

- Textbooks and school supplies

- Transportation

- Clothing

- Discretionary spending

If your student is paying for any of the tuition expenses out of pocket now, these costs should also be included, at the top of the budget.

Part of the important lesson of budgeting is not just having a better sense of the math that surrounds our daily activities, but also developing a greater understanding of the nature of the choices we make and habits we form—and how those choices accumulate. That’s why, in addition to breaking down expenses along the lines of wants and needs, expenses should also be categorized as fixed (stay the same each month), variable (change each month), and flexible (you can change these, based on your habits and choices). Your student’s “needs” and “wants” can fall into any of these categories.

Things like room and board costs will be mostly fixed—your student will need a place to live and a meal plan (or groceries, if they live independently)—even if they choose less expensive options. But textbooks will be variable, and clothing and transportation can be somewhat flexible, while still being “needs.” For example, choices like taking the Mountain Line or other public transit vs. hiring a car share or maintaining their own vehicle can be a huge cost differential. Discretionary expenses, which can be fixed (streaming services), variable (spring break trips), or flexible (nights out), are all inarguably “wants”. Anything leftover should be set aside for savings, even if this percentage doesn’t quite reach the recommended 20. Once you have a budget that balances income and expenses, revisit it with your student regularly, adjusting it any time there is a life change that alters their financial landscape.

If all this sounds like a lot, or even a little old-fashioned for your student, there are a number of apps and programs designed to help you track your expenses, and many can even be integrated with your bank account. The Balance offers this useful roundup of the best budgeting apps, with Mint coming in at #1. And for even more budgeting strategies and sample budgets, check out Best College’s Students’ Guide to Budgeting in College.

Work Together to Stay on Track with Discretionary Spending

College is an inherently social experience, and as such one of the biggest expenses your college student might face will revolve around entertainment and other discretionary spending. In order to keep budgets in check, talk to your college student about how to choose less expensive options. Even bringing to their attention that they may have a choice in their day-to-day and group activities between more affordable and budget-busting options can help them make smarter choices on the fly. Take some time to brainstorm money-saving alternatives, revisiting their options regularly.

Here are some ideas to get the ball rolling:

- Host a Netflix and pizza night with friends instead of going out to the movies.

- Have a potluck get-together where each guest brings something to eat or drink.

- Pick closer establishments that are walkable or can use student transit instead of having to call a ride share.

- Take advantage of student discounts. Most colleges provide students with lists or websites that catalog these discounts.

- Keep the Student Union in mind. Many colleges and universities host regular free or reasonably-priced events and activities for students.

- Not sure how to spend a free afternoon? Choose a free activity like a hike in Coopers Rock State Forest or use this guide to explore the public art around Morgantown.

Open a Student Checking Account

If your college student doesn’t already have their own checking account, now is the time to get one. In fact, many jobs will require or prefer direct deposit, and, as they begin to pay for their own expenses, they’ll need to have their own debit card for all those transactions, in an increasingly cashless world. Here are some additional benefits of opening a student checking account:

- Parental access. Parents have access to the account and can monitor spending. This can also help parents have a better understanding of their children’s daily habits.

- Financial assistance. Parents can add money to the account and help out their students if they get in a financial jam.

- Accessibility. Online and mobile banking lets your student access their account anytime and anywhere so they will always know how much money they have available and can easily compare their real-world spending habits with their budget.

- Text message alerts. With low-balance alerts, students can stay on top of their spending before it gets too far.

- And more. Beyond these common benefits, our student checking account offers a number of other perks, including unlimited check writing, a free debit card, and no monthly fees.

Additionally, by connecting your student’s checking account to a savings account, you can easily transfer those extra dollars each month into an interest-bearing account, perfect for emergency expense use. At First Exchange Bank, linking a savings and checking account also comes with overdraft protection, an important feature for those still developing their budgeting and spending skills. With our personal savings account, if the linked checking account is ever overdrawn, you can rest easy knowing that instead of incurring fees, the funds can come from the savings account instead.

Earn Income

While many parents view school as their child’s job, never accumulating one’s own income or work experience isn’t a smart choice for your student in the long run. Not only will it leave them less skilled at managing their own finances, but future employers prefer that students have an employment history to indicate their readiness for real life work. Even if a student is going to school full time, finding a manageable part-time job is key to setting out on their own after college.

Flexible work arrangements for students include:

- Federal Work Study Jobs: for schools participating in the Federal Work Study Program, qualifying students can be paid for part-time work through their school

- Part-Time Local Employment: Many local businesses that cater to students even prefer to offer some employment opportunities limited to the school year.

- Summer Employment: If your student is returning home for the summer, they can save money by living at home and working in their hometown, maybe even earning enough to avoid having to work during the school year.

- Paid Internships: Especially as your student begins their final years in school, internships can be crucial for creating the real world work experience and networking opportunities to land their first job. If you have the choice between a paid and unpaid internship, strongly consider whether that unpaid internship will be worth it. According to Harvard Business Review, “people with paid internships perform better in job fairs and end up with more job offers,” while “students who had never had an internship received the same number of job offers as unpaid interns.”

Build Good Credit

Once your student is responsibly managing their checking account and debit card and they have had a few years of employment under their belt, it may be time for them to apply for a credit card. Some students may be ready for this their junior year, while others might not be ready till the end of their senior year or later—as a parent or guardian, you can help them come to the decision if and when they are ready to start using credit.

While there are many caveats about young people and credit cards, using credit responsibly is an important life lesson, and having a good history of credit means gaining that essential access to credit for many milestones in life, from getting a car loan to buying their first home. But if your student isn’t ready to use credit wisely, getting a credit card can hinder these same goals.

Here are some tips on how to ensure your student’s responsible credit card use:

- Help them set a budget or spending limit on the credit card or choose a card with a low limit, like a gas card.

- Consider restricting the credit card for emergency use only.

- Discuss the importance of not carrying a balance and help them budget each month to ensure they can pay it off in full. At this stage in their life, they want to avoid paying unnecessary interest if they can.

- Consider a rewards credit card that can help reward them with cash back (when you’re a college student every little bit helps) or travel rewards that can help fund spring break.

- If the balance starts creeping up, have them stop using it before interest gets out of hand and focus on paying it down instead. By paying on time they will still build a history of good credit, and when the balance is back to zero, they can try again.

How We Can Help You and Your Student

At First Exchange Bank, we are here to help you and your student navigate those tenuous college years by taking the guesswork out of smart financial management. Our student and family-centered products from student checking to personal savings accounts, as well as our Visa® Rewards Platinum credit card with travel and merchandise rewards, can give your student the tools needed to budget, plan for the future, and build a strong financial history that will benefit them for years to come.

With online and mobile banking and locations in White Hall, Mannington, Fairmount, Morgantown, Hundred, and Fairview, we’re easily accessible to students and parents throughout West Virginia. Visit us today to see what we can do for you!