While interest rates on mortgages and other loans remain low, house values have risen across West Virginia. For many homeowners, this signals a perfect time to cash into their home equity to fund renovations and other home building projects. When it comes to funding home projects, a line of credit is often a better choice than a lump sum loan. You may have seen home equity lines of credit and personal credit lines advertised, but how do you know which line of credit is the right choice for you? At First Exchange Bank, we want to explain the difference between a HELOC vs. a personal line of credit and help you choose the right line of credit for your project.

How does a home equity line of credit work?

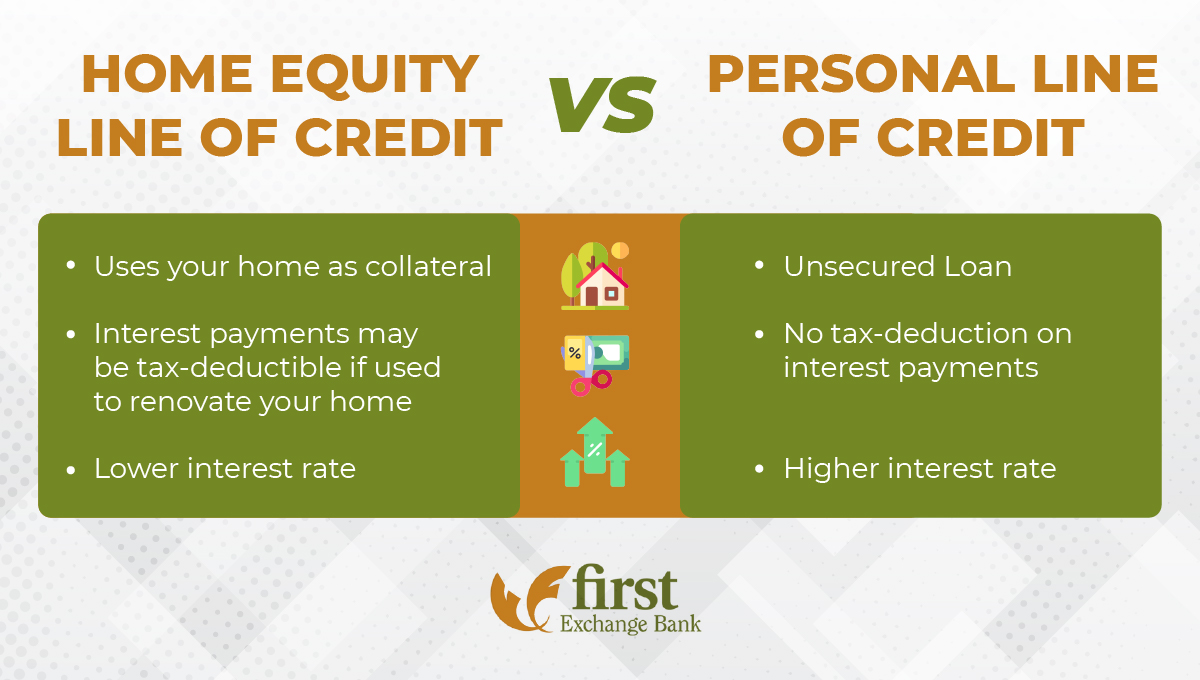

Often called a “second mortgage”, a home equity line of credit (HELOC) is a loan that uses your house as collateral just like your primary mortgage. Your home has likely recently increased in value due to nationwide increase in home prices. You should also owe less than the value of your home since you’ve been steadily making mortgage payments for years. The difference in your home’s current market value and the amount you owe on your mortgage is called your home equity.

If your house is currently valued at $225,000 and you owe $175,000 on your mortgage, your home equity is $50,000. Of that $50,000, First Exchange Bank can lend you $27,500 on a new home equity line of credit. Unlike a loan, a line of credit acts like a credit card with a spending limit. Instead of receiving the full sum at once, you use the loan in pieces as expenses arise. If a bank grants you a $27,500 HELOC, you can withdraw $5,000 for Project A now, $7,000 for Project B in three months, and so on.

Do I Qualify for a Home Equity Line of Credit?

Just like your mortgage, a HELOC is a home loan that uses your house as collateral. If you stop making payments on either your mortgage or your HELOC, the bank can seize your home and sell it to recoup their investment. Lenders are going to look at your Combined Loan to Value Ratio (CLTV) before extending a loan offer. Your CLTV ratio is calculated by adding the balance on your current mortgage to the new amount you wish to borrow then dividing the total loan amount by the current appraised value of your home.

For example, if you owe $175,000 on your mortgage and want to borrow an additional $30,00, your combined loan amount would be $250,000. If your home is currently appraised at $250,000, your CLTV ratio is $205,000 divided by $250,000 which equals 82 percent. Most banks prefer to issue loans with a CLTV of less than 80 percent. However at First Exchange Bank, we can issue loans with a CLTV of 90 percent! Any higher than that and the loan application may be denied.

There are many other factors that will go into approving your HELOC. At First Exchange Bank, we look at credit score, debt to income, and overall payment history.

Is interest on Home Equity Lines of Credit Tax Deductible?

Generally, interest on Home Equity Lines of Credit is tax deductible.*

What Are The Interest Rates On A HELOC?

The annual percentage rate (APR) you pay on a home equity line of credit is typically lower than that on a credit card or personal loan. Instead of locking in a guaranteed rate until the loan is paid off, the amount of interest you pay fluctuates as interest rates rise and fall. The variable rate of your loan is based on the benchmark prime rate. In general, HELOCs usually have a 30-year lifespan. You have ten years to draw money from the credit line and twenty years to repay the total amount borrowed. At First Exchange Bank, our HELOC’s have a 25-year life, ten year draw period, and fifteen year repayment period.

What Are The Pros And Cons Of A Home Equity Line Of Credit?

Advantages of a HELOC

- Interest payments may be tax deductible*

- Lower interest rate than credit cards and personal loans

- Most banks charge closing costs and fees, but not First Exchange Bank!

Disadvantages of a HELOC

- Risk losing your home if you don’t make payments

- Approval process is lengthy

- Variable interest rate could go up

How Does A Personal Line of Credit Work?

A personal line of credit is similar to a HELOC in that they are both lines of credit. As a borrower, you are approved for a certain amount much like a credit limit on a credit card. You then borrow funds as you need them and only pay interest on the sum borrowed, not the entire line of credit.

A personal loan is different from a personal line of credit. If you took out a personal loan, you would receive a lump sum payout and immediately be responsible for interest on the entire amount. A line of credit allows you to use your loan funds over time and avoid paying interest on the unused portion.

How Do I Qualify For A Personal Line Of Credit?

Because most personal lines of credit are unsecured loans, the bank is not holding your house, car, or any other property as collateral. This means you can qualify for a personal line of credit without being a homeowner. The bank is assuming the risk of this unsecured loan based on your personal credit worthiness. Creditworthiness is most easily determined by your credit score, debt to income, and overall payment history.

What Are The Tax Advantages of a Personal Line of Credit?

This is one of the differences between a HELOC vs. a personal line of credit. Unlike a home equity line of credit, interest payments on a personal loan are generally not tax deductible. *

What Are the Interest Rates On A Personal Line of Credit?

Interest rates on a personal line of credit are variable, just like HELOCs. The annual percentage rate (APR) is based on the benchmark prime rate. Most personal lines of credit have a minimum monthly payment and a final maturity date when all the borrowed money is due. If you secure a personal line of credit, be sure to plan out your repayments so you do not have a large balloon payment at the end.

What Are the Pros and Cons of A Personal Line of Credit?

Advantages of A Personal Line of Credit:

- No collateral needed for approval

- Quick decision making process

- Lower interest rate than a credit card

Disadvantages of A Personal Line of Credit:

- Higher interest rate than HELOC

- No tax advantages

Where Do I Apply For A HELOC Or Personal Line Of Credit

If you’re wondering which bank is best for a home equity line of credit, look no further than First Exchange Bank. Whether you live in White Hall, Mannington, Fairmont, Hundred, Fairview or Morgantown, or points beyond, residents of West Virginia trust First Exchange Bank as their community lender. We’ll help you find the right loan or line of credit to fit your needs. Both HELOCs and personal lines of credit are available to our customers, and our friendly associates are happy to discuss our current interest rates and terms. To learn more or apply for a line of credit loan with First Exchange Bank visit one of our convenient locations in White Hall, Fairmont, Fairview, Hundred, Morgantown, and Mannington or contact us online.

*Please consult your tax adviser to determine if interest is tax deductible for you.