How do you feel about budgeting? Some people seem to be born with a budget in hand, while others struggle to create and stick to a budget. Whether it comes naturally or not, it’s worth the effort to try different methods until you find one that works for you. Developing a budgeting habit can help you gain control over your spending, improve peace of mind, and stay on track to meet your long-term financial goals. Keep reading to learn how to start a budget today!

What is a Budget?

While some people think of a budget as a restrictive device–a financial cage, so to speak–a good budget should be more like a roadmap. Budgeting sets your course while still leaving room for impromptu stops and other detours.

Non-metaphorically speaking, a budget can be a list on paper, a spreadsheet, or a digital app. With so many budgeting methods out there, you may have to try several before finding the best one for you. Don’t get discouraged if you have a few false starts. Like any new habit, it can take time for budgeting to stick.

In its simplest form, the best budget should list your monthly take-home pay, all monthly bills, and essential expenses such as groceries. You can also budget one week or one pay period at a time. Subtract total bills and expenses from total income and then comes the fun part–deciding what to do with the remaining money available.

Why Do You Need A Budget?

Before you create a budget, it may be helpful to reflect on the reasons why you need a budget. Are you budgeting your money for a specific reason, such as to reach a savings or debt payoff goal? Are you tired of running out of money before you get paid again? Budgeting will give you a clear-eyed picture of where your money actually goes (all of us tend to underestimate the amount we spend on things like dining out, hobbies, clothing, and more). Once you know what you’re spending on, you can make the changes needed to align your spending with your goals.

Budgeting can help you:

- Save more money

- Reduce spending on things you don’t use or care about

- Avoid overspending and break the paycheck-to-paycheck cycle

- Stop fighting about money and improve your communication with your spouse or partner

- Get out of debt

- Stay on track with your long-term savings goals for retirement, a child’s education, and more.

- Be prepared for life’s unexpected twists and turns

- Achieve a sense of financial stability

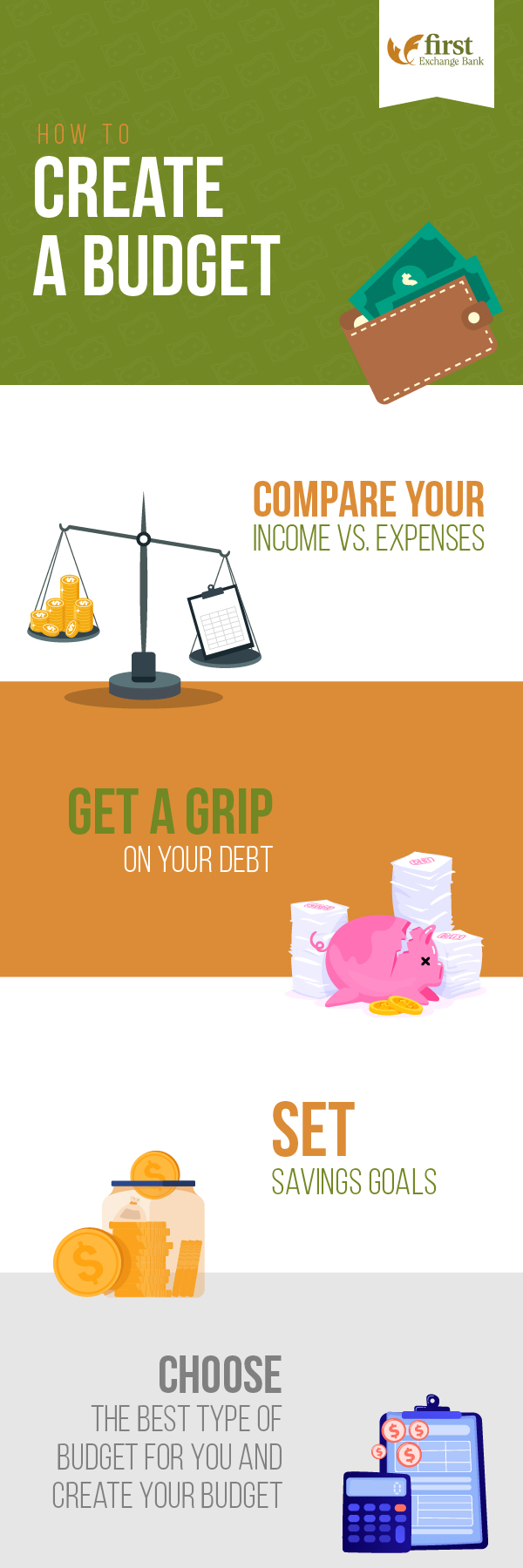

How to Set Up A Budget

As we’ve said, setting up a budget gives you an understanding of your financial situation including your income, expenses, debt, and savings goals. Follow these steps to set up a budget that works for you.

Income vs. Spending

Create spending categories and list your bills, expenses, and discretionary spending. It may help to review last month’s bank statement to see exactly where your money went.

- Bills such as rent or mortgage, utilities, phone and Internet, insurance premiums, etc.

- Debt payments (besides mortgage) for car loans, student loans, or credit card balances

- Fixed vs. variable expenses such as gas, groceries, home and car maintenance, etc. (Estimate for variable expenses)

- Necessary vs. Unnecessary expenses such as restaurant meals, entertainment, shopping, and more (we’re not saying you can’t have any unnecessary expenses, just that you need to track them)

Hopefully your income is higher than your expenses, with a comfortable margin leftover to allocate toward savings, extra debt payments, and discretionary spending. If not, you’ll need to do what you can to cut unnecessary expenses.

Get a grip on your debt

While certain kinds of debt, such as a home mortgage, can be necessary and helpful, most other kinds of debt can drag down your budget. Essentially debt, especially credit card debt, is a claim on your future income. Just think about what you could do with that extra money in your budget if you didn’t have a student loan payment, credit card payment, or other type of debt payment anymore.

Feeling motivated to vanquish your debt? Take stock of how much you owe by listing each debt account, the current balance, and interest rate.

Next, choose a strategy for paying off your debt. For example, the snowball method of debt payoff means starting with the lowest balance and throwing as much money as you can at it each month while making minimum payments on everything else. Then you’d move on to your next-lowest balance and so on.

Alternatively, the avalanche method of debt payoff means starting with the account with the highest interest rate, regardless of balance. Some people want a faster win from starting with the lower balance, while others want to save as much money as possible on interest paid.

If you have a lot of debt and it seems difficult to manage, you may want to consider a debt consolidation loan to make your life easier. Consolidating multiple debt accounts with one new loan, usually at a lower interest rate, means just one monthly debt payment and can help debt fit into your budget better.

Set Savings Goals

As the saying goes, “pay yourself first.” Savings should be a line item in your budget, whether you have a particular savings goal such as buying a house, building an emergency fund, or growing a nest egg for retirement.

Individual savings goals will vary, but everyone should contribute to an emergency fund and a retirement account such as a 401(k) or IRA. The easiest way to save is to automate. For example, you can schedule recurring transfers between your First Exchange checking and savings accounts. We also offer Roth and Traditional IRAs. If your employer offers a 401(k), you can schedule automatic contributions from your pre-tax paycheck. Find out if your employer will also match up to a certain percentage of your contributions.

Another way First Exchange Bank can help you with your savings goals is with Round Up. Round Up from First Exchange Bank allows debit cardholders to round up every point-of-sale transaction to the next dollar (or dollar increment), and deposit the extra amount to your First Exchange Bank savings account that is linked to your debit card.

Create Your Budget

Once you’ve allocated the appropriate amount of money towards your fixed bills and expenses, decide how you want to divvy up the rest. This could consist of extra debt payments, savings contributions, “fun money,” and more.

If you want a formula to follow, a common rule of thumb is the 60/20/20 guide. This consists of:

- 60% of your net income goes to necessities

- 20% for discretionary spending

- 20% towards building your savings or paying off debt

Find The Best Budget For You

Of course, your budget doesn’t have to follow the 60/20/20 rule or any other rule. Find a breakdown that works for you, in whatever stage of life you current find yourself in. For example, parents of young children may need to devote a significant amount of their budget to childcare, diapers, and other related expenses. The bottom line is that there are many approaches to budgeting out there, but they all boil down to balancing needs vs. wants. Use whatever works for you and remember that your budget isn’t carved in stone. It can and should be adjusted as needed to reflect your reality. Give your finances a yearly checkup and keep or adjust your budget accordingly.

Start A Budget Today!

First Exchange is here to help you create a budget that works for you. Open a new checking or savings account online or visit any of our bank branch locations in North Central West Virginia including Mannington, Morgantown, Hundred, Fairview, Fairmont, White Hall. Enroll in online and mobile banking to easily keep track of your accounts on the go and link them to the budgeting app of your choice.