When was the last time you reviewed your finances? While it’s important to conduct a financial checkup whenever your life situation changes, it’s also good to get into the routine of reviewing your finances once a year. As you take stock of the past year and your progress toward personal goals, a financial checkup is an opportunity to review your progress toward financial goals and determine any course corrections needed to get you back on track.

Check Your Credit Score

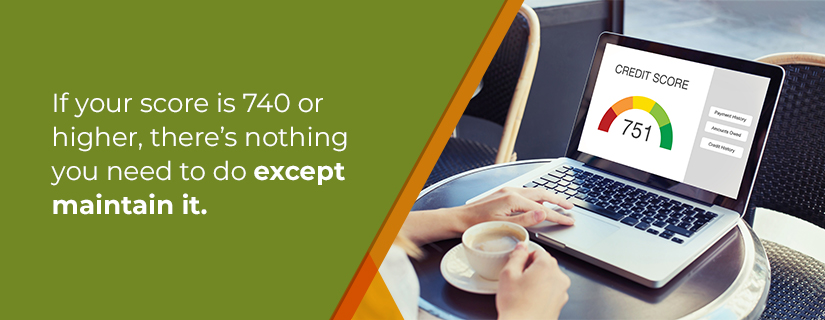

Your credit score is an important indicator of your overall financial health. Check yours now and understand where it falls on the range:

- Exceptional: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

Some credit card accounts offer free access to your score as a perk. Check to see if you can view your credit score that way. If not, you can purchase a report from any of the major credit reporting bureaus.

If your score is 740 or higher, there’s nothing you need to do except maintain it. If it’s lower than that, you may want to take steps to improve it, especially if you plan to apply for a mortgage or other type of loan in the coming year.

The primary factors used to determine your credit score are:

- History of on-time payments

- Credit utilization (the percentage of your total borrowing limit that you carry as a balance on your credit cards)

- Length of credit history

- Credit mix

- Recent applications for new credit accounts

If your credit score isn’t where you’d like it to be, work on improving your performance in these areas by making on-time payments, paying down credit card balances, and not closing old accounts or opening new ones.

To maintain a good credit score, keep your current accounts open and make at least one purchase per month on your credit cards to show responsible usage and on-time payments.

Determine Your Financial Goals

Knowing your big picture destination will help you stick to good money habits in your day-to-day life. Take some time now to review your short-term and long-term goals, deleting or adding things as needed.

Short-Term Goals

This is anything with a timeline from several months to a few years. For example:

- Building an emergency fund

- Buying your first house

- Paying off a student loan or credit card balance

- Saving for a large purchase, such as a new couch

- Saving for a vacation or travel

- Saving for a wedding

- Saving for a small home improvement project

Long-Term Goals

These will take longer than a few years to reach. For example:

- Growing your retirement savings

- Paying off your mortgage

- Saving for a child’s college education

- Starting a business and applying for business loans

- Saving for a larger home renovation project

Review Your Budget

Once you’ve reviewed and updated your goals, it’s time to create or refresh your budget.

- Calculate your monthly take-home pay. Has it changed recently?

- Add up your fixed monthly bills, plus necessities like groceries and transportation.

- Review your current subscriptions and eliminate any that are unnecessary.

- Automate your savings, whether that means increasing your 401(k) contribution, setting up a recurring transfer between your checking and savings accounts, or signing up for Round Up from First Exchange Bank. Round Up allows debit cardholders to round up every point-of-sale transaction to the next dollar (or dollar increment). You can choose to round up and deposit the extra to your First Exchange Bank savings account that is linked to your debit card.

- Allocate money in your budget for your short- and long-term goals.

- Make sure there’s enough leftover for some “walking around” money. Adjust as needed and check in with your budget regularly, perhaps daily at first and then weekly or bi-weekly.

Develop a strategy to lower your debt

Is credit card or student loan debt weighing you down? If your budget permits, try to allocate more money towards paying off your higher interest debt.

Good Debt vs. Bad Debt

Financial advisors will usually tell you not to worry about paying off home and auto loans early, as they typically have fair interest rates and are attached to an asset. However, other types of debt, especially unsecured credit cards and personal loans, as well as student loans, can hamper your financial future and eat up your budget with monthly interest charges. This is the “bad” debt you want to pay off as soon as possible.

Debt snowball vs. Debt avalanche

When it comes to paying off higher interest debt, there are two approaches to choose from: debt snowball and debt avalanche.

- With debt snowball, you start with the lowest balance and throw any extra money at it until it’s paid off, while making minimum payments on your other debt.

- With debt avalanche, you choose the account with the highest interest rate, regardless of balance size.

- With both the snowball and avalanche approaches, you focus most of your firepower on one account at a time, building momentum with the achievement of reaching a zero balance.

Debt consolidation

Develop a healthy strategy to lower your high-interest debt. Don’t put all of your money towards paying off your debt and not have anything left for the things you want and need. Though it may sound counterproductive, there are some loans that can help you lower your debt. Here are loans offered by First Exchange Bank that can help you with debt consolidation.

- Mortgage refinance: Cash out your home equity to pay off higher interest debt at a lower rate.

- Home Equity Line of Credit: Borrow against your home’s equity with a line of credit and use the funds to pay off higher interest debt.

- Personal Loan: If you don’t have enough equity in your home or are not a homeowner, secured personal loans and unsecured personal loans may offer lower interest rates for debt consolidation, as well as the convenience of making just one monthly payment instead of several.

- Personal Line of Credit: Similar to a personal loan, but with more flexibility to be used more than once.

Review Your Savings Plan

Run through this checklist to keep your savings goals on track:

- Do you have an emergency savings account? If not, now is a good time to start. Aim for 3-6 months of living expenses.

- Are you saving for retirement? Take advantage of your 401(k) at work or open an Individual Retirement Account (IRA) to enjoy tax-advantaged savings for retirement.

- What about your short-term savings goals? Consider a CD for a higher rate of return on your savings. (Read more about investing in CDs.)

- Are you setting your child up for a healthy financial future? Open a Minor Savings Account.

- Review any other investments you own, such as real estate and individual stocks.

Make sure your insurance policies are still relevant

Review your health, life, auto, and other supplemental insurance policies.

- Update your beneficiaries if this has changed in the past year.

- Do you need to increase your life insurance?

- If you paid off or recently paid off a mortgage or vehicle, let your insurer know so they can update their records.

- This is also a good time to evaluate your coverage and make sure that what you have is still relevant. Maybe there are ways to save money; for example, are you driving less? No longer have children on your health insurance plan?

- If you have pets, look into pet insurance to see if it makes sense for you.

Evaluate your Estate Plan

Do you need to create or update your will? What about trusts and power of attorney documents? As with insurance policies, you should make sure your beneficiaries are up-to-date on your will and other estate planning documents.

Simplify your Finances

If too many accounts are complicating your budgeting and money management, aim to simplify. First Exchange Bank has the financial products and services than can help you take control of your budget.

- Combine Accounts: If you have multiple checking or savings accounts with multiple banks, move everything to the same bank. First Exchange Bank’s friendly and knowledgeable staff can help set-up your new accounts and tailor a banking program that fits your lifestyle. Visit one of our six locations or get started on opening a deposit account online today or read more about how to choose the right checking account.

- Have an Old 401K? Roll it over to your current employer or open an IRA with First Exchange Bank.

- First Exchange Bank make things easier with our online and mobile banking. Monitor your accounts, make transfers, and set-up text alerts to give you even more control over your finances.

- Save a stamp and a trip to the bank by paying bills online with Bill Pay.

- Reduce paper clutter by signing up for e-statements.

- You can save even more time with mobile deposits. Deposit checks without having to go to the bank.

Let us help you improve your financial health!

Did your financial check-up reveal a need to improve your financial health? First Exchange Bank has been assisting West Virginians with their financial goals since 1932. Get started with a savings account or retirement account to secure your financial future. Talk to a lender to find the best options for debt consolidation loans or a home equity line of credit. Contact us today or visit your nearest location in White Hall, Fairmont, Mannington, Fairview, Hundred and Morgantown.